What happened during previous property market downturns?

Interest rates are moving higher – and quickly – and fears of a steep and lasting decline in home prices are mounting.

Some forecasters have warned the impending correction will see a 30% fall in property prices from their peak in March this year. More moderate forecasts estimate a 10-20% decline.

However, it is important to put these predicted price falls in context.

We have seen extraordinary growth in housing prices over the past two years – a staggering 34% increase cumulatively since the pandemic onset in February 2020

So, should you be worried? And if so, how worried?

So far this year, interest rates have risen sharply, with the Reserve Bank of Australia hiking the cash rate three times since May, taking it from a record low of 0.1% to 1.35%.

That will likely rise even higher at the same fast pace, with the RBA reiterating the boards’ determination to overcome the challenge of high inflation and do “what is necessary” to rein in inflation pressures.

Interest rates have risen 125 basis points in the past three months and are expected to increase another 50 basis points in August.

Market pricing currently implies a cash rate of close to 3.5% by December.

The impact of this fast pace of rate rises is the slowing and decline of property prices around Australia.

As interest rates have risen, home price growth has slowed nation-wide, and prices have quickly begun to fall in some regions. The PropTrack Home Price Index shows a national decline of 0.55% since March.

Mortgage rates have moved higher, and many can no longer borrow the same amount as this time last year. As rates continue to climb, borrowing capacities will be further constrained.

This means prospective buyers not only face higher borrowing costs, but also greater uncertainty over future mortgage servicing costs than those over the past two years.

This is being reflected in the housing market. Potential buyer demand has slipped as confidence erodes and the fear of missing out subsides. Auction volumes and clearance rates have fallen, and sales volumes have slowed off last year’s levels.

We expect these trends to continue, with home prices likely to keep falling through this year and into next year.

Those declines are likely to accelerate and become more widespread over the coming months.

So, what have past downturns looked like?

Whilst history is no predictor of the future, examining previous downturns may provide insights into what to expect.

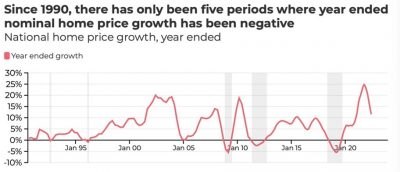

Since 1990, there have been only five periods when year-ended nominal home price growth has been negative.

Those downturns have never been greater than 10% in year-ended terms. And in every instance, the preceding upswing has been larger than the downturn that has followed.

Looking even further back to 1880, adjusted for inflation, price declines of 30% have never occurred.

That’s not to say that what we’re seeing now, which is the most aggressive tightening cycle in more than 40 years in terms of the ratio of debt-servicing costs relative to disposable incomes, won’t warrant a correction in house prices.

But whether those declines will be close to 30%, as some predict, is another question entirely.

As rising interest rates weigh, we currently expect national price declines in the order of 9% to 15% by the end of 2023, with Sydney and Melbourne seeing larger declines, and Adelaide, Perth and Brisbane remaining more resilient.

How long and steep have recent downturns been?

According to Prop Track’s Home Price Index, in recent history, Australia-wide downturns have lasted an average of between nine months and ten months, with prices falling on average 2.8% from peak to trough.

Read More >>