June 13th | Auction Clearance Rates for Australia’s Five Major Capital Cities Released, Sydney’s Auction Clearance Rate Reaches 70% Again.

June 6th: In Sydney, there were a total of 313 properties participating in auctions, with 167 auction results reported. Out of these, 127 properties were sold, resulting in a clearance rate of 57%. The total value of the auctions was AUD 105,701,888, with a median house price of AUD 1,210,000.

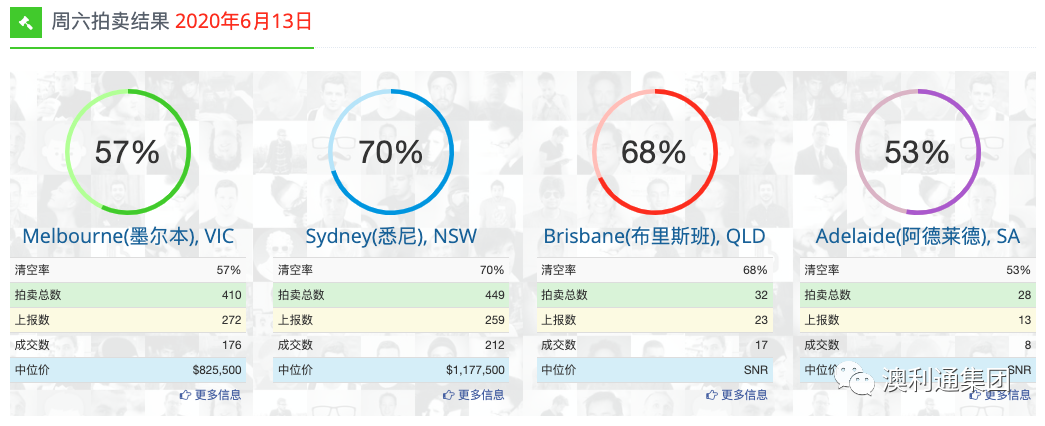

June 13th: In Sydney, there were a total of 449 properties participating in auctions, with 259 auction results reported. Out of these, 212 properties were sold, resulting in a clearance rate of 70%. The total value of the auctions was AUD 136,527,500, with a median house price of AUD 1,177,500.

June 6th: In Melbourne, there were a total of 143 properties participating in auctions, with 92 auction results reported. Out of these, 58 properties were sold, resulting in a clearance rate of 56%. The total value of the auctions was AUD 34,026,046, with a median house price of AUD 737,000.

June 13th: In Melbourne, there were a total of 410 properties participating in auctions, with 272 auction results reported. Out of these, 176 properties were sold, resulting in a clearance rate of 57%. The total value of the auctions was AUD 120,357,201, with a median house price of AUD 825,500.

June 6th: In Brisbane, there were a total of 23 properties participating in auctions, with 11 auction results reported. Out of these, 4 properties were sold, resulting in a clearance rate of 33%. The total value of the auctions was AUD 2,035,000, with no median house price reported.

June 13th: In Brisbane, there were a total of 32 properties participating in auctions, with 23 auction results reported. Out of these, 17 properties were sold, resulting in a clearance rate of 68%. The total value of the auctions was AUD 7,270,500, with no median house price reported.

June 6th: In Adelaide, there were a total of 9 properties participating in auctions, with 4 auction results reported. Out of these, 4 properties were sold, and the clearance rate was not available. The total value of the auctions was AUD 1,196,500, with no median house price reported.

June 13th: In Adelaide, there were a total of 28 properties participating in auctions, with 13 auction results reported. Out of these, 8 properties were sold, resulting in a clearance rate of 53%. The total value of the auctions was AUD 2,339,000, with no median house price reported.

June 6th: In Canberra, there were a total of 19 properties participating in auctions, with 14 auction results reported. Out of these, 9 properties were sold, resulting in a clearance rate of 64%. The total value of the auctions was AUD 8,400,000, with no median house price reported.

June 13th: In Canberra, there were a total of 25 properties participating in auctions, with 23 auction results reported. Out of these, 16 properties were sold, resulting in a clearance rate of 70%. The total value of the auctions was AUD 9,241,000, with a median house price of AUD 755,500.

According to the latest data from Domain, the number of properties listed for sale has increased significantly, particularly in Sydney, where new listings have risen by 46% in the past four weeks. Similarly, Melbourne has seen a 22% increase in new listings compared to the previous four weeks.

Trent Wiltshire, an economist at Domain, mentioned that the surge in new listings in Sydney reflects growing confidence among buyers and sellers as the recovery appears better than expected.

However, despite the increase in listings, the market’s boost from easing restrictions may have reached its peak, as the clearance rate over the past weekend showed no significant improvement. According to data released by CoreLogic on Thursday, the clearance rate was 56.2%, below the typical threshold of 60% associated with price increases.

Wiltshire also highlighted that while sales have rebounded from the sluggish levels of April, they still remain below average. He predicts that the pandemic has primarily affected sales activity rather than prices.

Regarding price expectations, the Westpac-Melbourne Institute’s Price Expectations Index indicates a slight improvement compared to April but remains weak compared to pre-pandemic levels. Bill Evans, Chief Economist at Westpac, mentioned that although there is an increase in people considering it a good time to buy property, the survey still indicates a decline in price expectations compared to a few months ago.

According to CoreLogic’s statistical data, from June last year to June 13th this year, Sydney and Melbourne have experienced price increases of 14.08% and 11.12%, respectively. Brisbane (including the Gold Coast) saw a 3.97% increase, Adelaide experienced a 1.99% increase, while Perth, the capital of Western Australia, saw a 2.5% decrease. Overall, the housing price growth rate for the five major capital cities is 9.2%.